Events, Travel and the New Normal

02/9/2021

by: Dana Lattouf

Time to read: 10 mins

Following the vaccine, we've looked into which steps the industry needed to take next.

The travel and events industries have responded positively to recent news on progress COVID-19 vaccine trials. Venues are re-opening and operators are sharing their plans on how they plan to keep their visitors safe.

We wanted to consider the extent to which travel and experience consumers share this optimism. Our data was collected in November 2020 from a global audience (53% North America, 23% Asia Pacific, 14% Europe, Middle East and Africa & 10% Latin America). The sample was made up of 59% male and 41% female respondents, with 55% falling into the Millennial age category (25-38), 24% Gen-X (39-55), 17% Gen-Z (18-24) and the remaining 4% were Baby Boomers or older (56 years plus).

The purpose of the research was twofold:

- We wanted to understand people’s attitudes to travel 2021, and particularly to attending events and engaging with experiences while away from home.

- We knew that travellers’ plans would be affected by COVID-19, but we wanted to know what venue providers and ticket vendors could do to re-assure them of their safety.

Three key take outs from our findings

We believe this report provides useful insight for the travel and events sector in how to communicate with consumers as they plan safe, memorable experiences for 2021.

- There is clear evidence in our survey of pent-up demand for travel and leisure experiences, with over 59% of our respondents actively researching their plans for 2021.

- When it comes to events and experiences while travelling, spontaneity has taken a back seat: 85% intend to book everything ahead of time, with the majority saying that COVID-19 has prompted this decision.

- Naturally, health and safety are top-of-mind concerns for people and they feel that they are responding to a ‘new normal’. Interestingly though, their self-reported intentions do not vary dramatically from prior trends. This highlights that the ‘new normal’ may not be a radical shift, but that consumers seek re-assurance throughout the process.

Background

Over the past decades, travel saw consistent growth even when financial crises and pandemics affected the global economy, but the scale of damage from COVID-19 is even greater than that experienced previously. Despite this, people have not lost their appetite for travel. In fact, 60% of respondents ranked leisure travel as the number one activity that is missed most while waiting out the pandemic; a statistic that was consistent across age groups, income levels and countries. In other research, a significant proportion rank going to a sports event, concert or family entertainment as one of their top five activities they are eager to get back to.

With recent good news about multiple vaccine trials showing positive responses, the industry is poised to respond to an upshift in demand. To date, conventional wisdom in the industry has suggested that consumer behaviour will not be radically altered over a sustained period.

“I can’t possibly put real numbers on it, but the notion that it will fundamentally change, no. Not at all—I mean, not because of this pandemic.”

Steve Kaufer of TripAdvisor for McKinsey

We talked to Ola Zetterlof, CCO at ArrivalGuides – A Lonely Planet Company, who broadly agreed: “I don’t see a sustained shift in consumers’ travel habits and I expect bookings to happen in advance, especially for in-destination experiences. At least in the short-term, we will see a demand for more information prior to booking. I’m interested to see insight into what’s most valuable to travellers as they plan their trips.”

Our findings

Travel plans

It was clear that our respondents were keen to get back to travel with 78% planning to travel away from their home country more than once in 2021. 1

Interestingly, there was evidence that travellers are thinking about safety while travelling and in their accommodation: 46% intend to cross-borders by car, 34% using air travel and the remainder by train or boat.

We expected that hotels and hostels would be the most frequent destination (49.3%) but, surprisingly, this was only marginally ahead of those expecting to be hosted by family and friends.

We concluded that this trend was due to two factors: that respondents would be keen to catch up with their loved-ones and that they can be sure to be safe. Having plans to travel abroad for a vacation, work or study trip was a pre-requisite for participating in the study and 22% stated an intention to travel once in 2021.

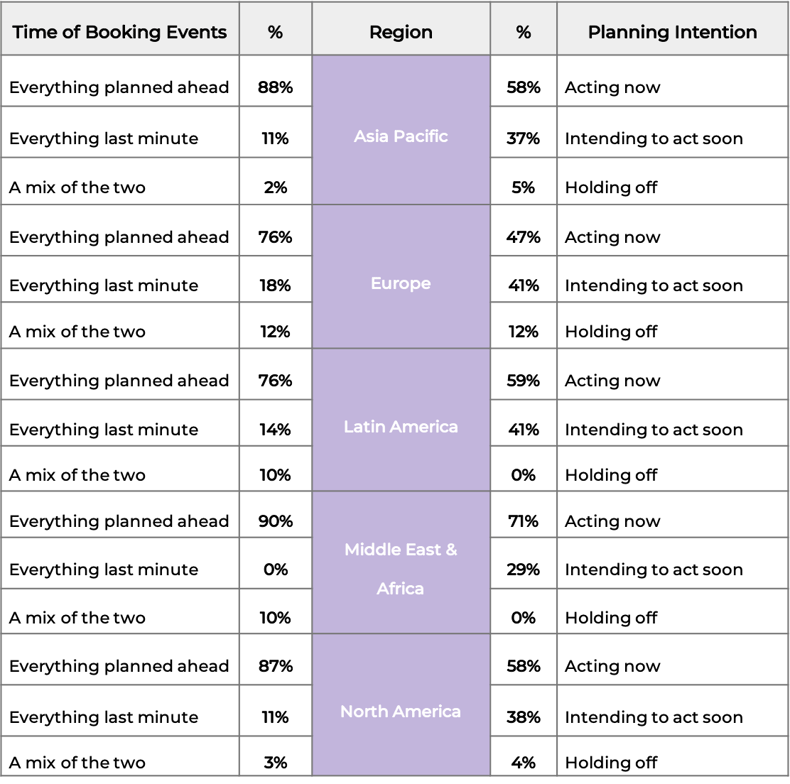

Table 1: Booking intentions around the globe

Events and activities while travelling

It is clear that our respondents want to get back to normal with the activities they plan while travelling next year. There is a clear desire to get out and about while travelling: over 90% of respondents told us that it was important for them to be able to book travel experiences again, post COVID-19.

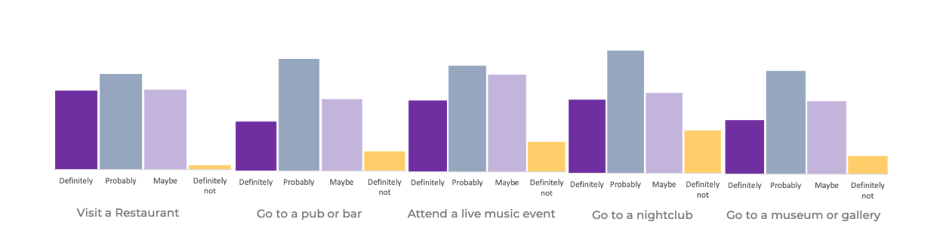

Figure 1 indicates their intention to engage with social and cultural events, albeit that the conditional nature of many of the responses indicates the ‘if all goes well’ attitude that we can empathise with.

Figure 1: Intended activities while travelling in 2021

Interestingly, almost all of our respondents told us that their plans had affected their decisions on events or activities they plan to engage in. The vast majority (78%) indicated that the effect was significant, indicating that their safety was a primary factor.

One of the ways this was made evident in our data was the proportion of respondents who intend to book their tickets for events ahead of time. Only 11% said they’ll ‘take it as it comes’ and book tickets in location. An even smaller number said they would mix and book the big ones ahead but plan to be inspired when they get there. The majority (85%) intend to minimise the risk with everything being planned and booked ahead of time.

Reassuring attendees of their safety

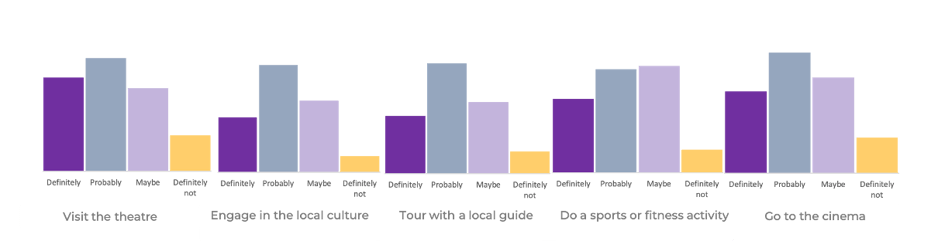

One of our key findings was that it is clearly incumbent on venue operators, ticket companies and experience makers to inform, educate and convince their customers that they will be safe while in their care. This was by far the most important factor and Figure 2 goes some way to illustrating the relative importance of some of the key information that travellers want to see when booking.

For completeness, we gave respondents the opportunity to indicate if this was not a priority for them, but the proportion was very low2.

Figure 2: Factors that reassure

But this is not the end of the story. As well as evidence that the event or experience was being held in a safe environment, respondents told us that (with roughly equal weighting) clear refund statements and trust in the company selling the ticket itself was important.

This offers clear lessons to venue owners and experience makers in terms of the information provided in their marketing, booking and terms information. However, it should also prompt questions about the channels through which the tickets are bought. If venues and operators are partnering with brands the consumer already trusts, this is clearly a factor in the dynamics of the travel and events sectors in the future and should affect their channel strategy.

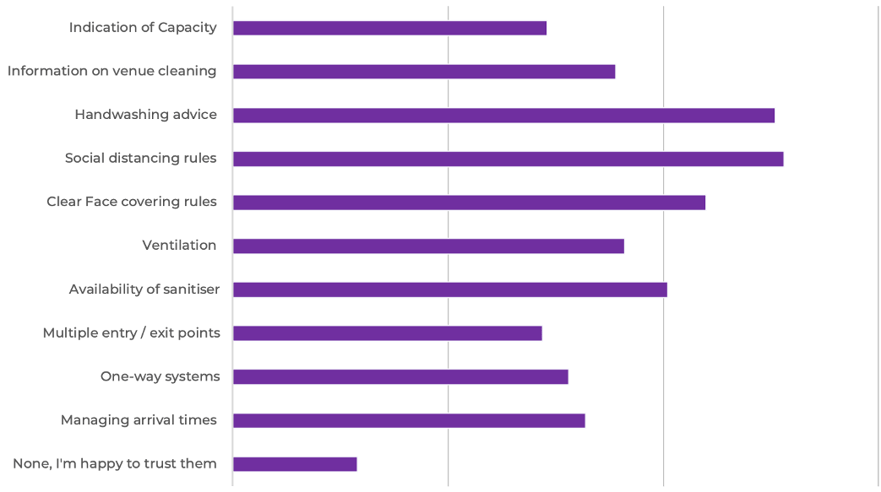

Evidence of being COVID free

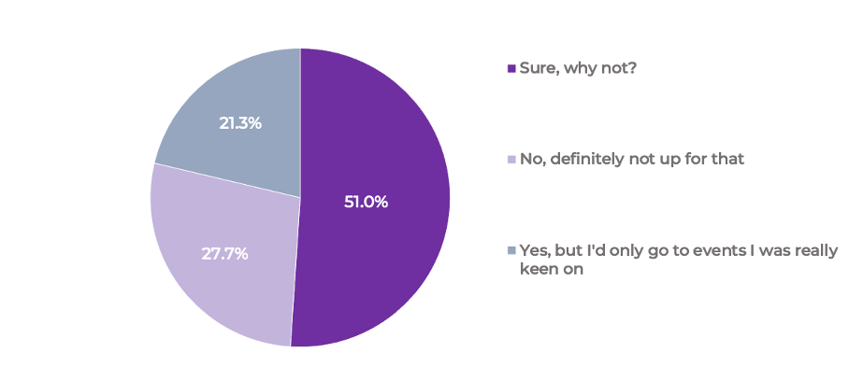

In our final section, we asked respondents how they would feel about being asked to test and provide evidence of being COVID-negative in order to be able to attend an event. Figure 3 indicates the responses with a surprisingly positive reaction.

Figure 3: Response to COVID testing in order to attend an event

In addition to our quantitative expression of respondents’ reactions, we also asked their opinions and, in many cases, they told us they see participation in initiatives such as this as a civic duty and simply playing their part in containing the pandemic. In the words of one: ‘It’s a new normal, so we’ll keep moving on’. Others talked about it having a positive effect on their experience as it will keep them ‘stress free’ if they know they are safe from and safe to others around them. Conversely, while the numbers who were not in favour were a minority (28%), this still is significant and many felt strongly about ensuring their own safety.

Demographic differences

As indicated above, our respondents represented views from around the world, albeit with slight skews towards North America (53%), Millennials (55%) and those who identify as male (60%). In order to minimise any negative affect from this, we looked into differences across different variables and found broad consistency. Using appropriate statistical methods for our data3, we found no differences between responses between males and females or between gender.

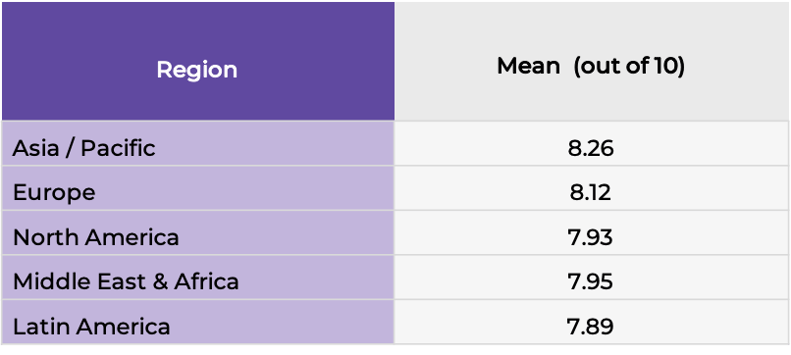

When it came to considering regional differences, we had mixed responses. For example, when looking at how important it was for respondents to get back to being able to book events and experiences while travelling, we noted general uniformity (see Table 2). This is an encouraging sign for the sector indicative of a pent-up demand that will provide a needed economic boost in 2021.

Table 2: Mean per Region

However, when it came to responses to providing evidence of COVID-negative status prior to attending an event, while we saw no differences in attitudes between males and females or across generations, we did note interesting differences by region.

The proportion who were against was consistent across all five regions (broadly 28% as shown in Figure 3).

In North America and Europe, the proportions that needed convincing to accept this across all events, not just the important ones were broadly equal.

In the Middle East & Africa, Latin America and Asia / Pacific regions, our respondents were more inclined to accept this practice across the board.

For brands wishing to communicate rules on providing COVID-negative status in events in NA and EU, it may be advisable to provide a higher degree of explanation on the value of the measure than for attendees in MEA, LA and AP.

Final remarks

When considering our findings and conclusions we wanted to consult with an outside expert for further insight. Dr Ben Marder at the University of Edinburgh’s Business School has published widely on consumer behaviour in the travel sector and is a highly sought-after commentator on consumers’ use of social media.

“There’s no doubt that the COVID-19 pandemic has affected consumers’ attitudes to travel and it’s encouraging to see that there is a keen-ness among the respondents in this study to return to normal, albeit a new-normal as reflected in these findings.

“In a related study carried out on behalf of the British Educational Travel Association we found that evidence of safety was key for travellers making choices about their destination and accommodations and it is interesting that this perception applies similarly to the events they will attend while away.

“We think this speaks to the care and attention brands, specifically ones in the travel and events space, need to pay to the ways in which they signal their COVID-safe measures. While the regional differences are small in this area, it underlines how important this factor is, albeit with nuances by region.”

We carried out this research as we wanted to contribute to the debate about how travellers intend to plan their trips and experiences post-COVID, and – most pertinently – how companies in the sector can re-assure them and help them with their decisions.

We concluded that consumers simply want an open, honest conversation about what measures are in place and where their risks lie. It seems to us that they will reward the companies who make this easy for them.

Of course it is important to to be wary of self-reported data, particularly when it relates to future intentions and we’ll be watching the behavioural data through our own platform and public sources with interest.

This paper was researched and collated by the team at Tickitto as part of a series which we want to share with clients, partners and anyone interested in the travel and events sector.

If you would like us to share future research with you directly.

We’d be especially interested in hearing from you if you would like to collaborate on future research or even if there’s a question you’d like us to look into. Please let us know by emailing hello@tickitto.com.

Footnotes:

1. Having plans to travel abroad for a vacation, work or study trip was a pre-requisite for participating in the study and 22% stated an intention to travel once in 2021.

2. Respondents were asked to indicate all that applied to them but the chart indicates the relative importance of each factor.

3. Pearson Chi-Squared Tests using a 0.05 threshold.

Next Up

Start selling tickets in just 2 weeks

Join the growing number of businesses offering a seamless, end-to-end ticket buying experience. It’s never been easier.